Addressing Healthcare in Retirement: Protecting Your Future

March 17, 2023

By Andi McNamara, CFP®

Vice President, Director of Financial Planning

Washington Trust Wealth Management

According to a HealthView Services study, an average 65-year-old healthy couple can expect their lifetime healthcare expenses to add up to $597,389 – and that’s not including the cost of long-term care or accounting for inflation.1 Unsurprisingly, therefore, in the 2022 Retirement Confidence Survey (RCS), 35% of all workers reported they were either “not too confident” or “not at all confident” that they would have enough money to pay for their medical expenses in retirement.2 Many Americans fail to consider healthcare as part of their financial plan at all, and when you add this kind of stress to a financial plan, many otherwise successful plans could fail (in other words, retirees will run out of money).

Does your plan adequately address your immediate, ongoing, and long-term healthcare needs and costs? This paper will help you identify and understand some of the healthcare costs you may face and how to work with a wealth advisor to develop a plan that will ensure those costs are covered through your retirement.

Increasing Cost of Healthcare: When Will It Stop?

From 1960 to 2019, healthcare costs increased from 5.0% to 17.7% of the Gross Domestic Product (GDP). Economists theorize that costs will continue to rise until they reach a breaking point. Based on research from Milliman and the Society of Actuaries (SOA), the limit on health care spending is currently projected to be reached around the year 2074, at roughly 29.4% of the GDP.

In retirement, you may face several types of healthcare expenses, including Medicare premiums, out-of-pocket-costs not covered by Medicare, the cost of supplemental insurance, and the cost of long-term care not covered by Medicare. All of these healthcare costs are continuing to rise at staggering rates – higher than the rate of inflation.

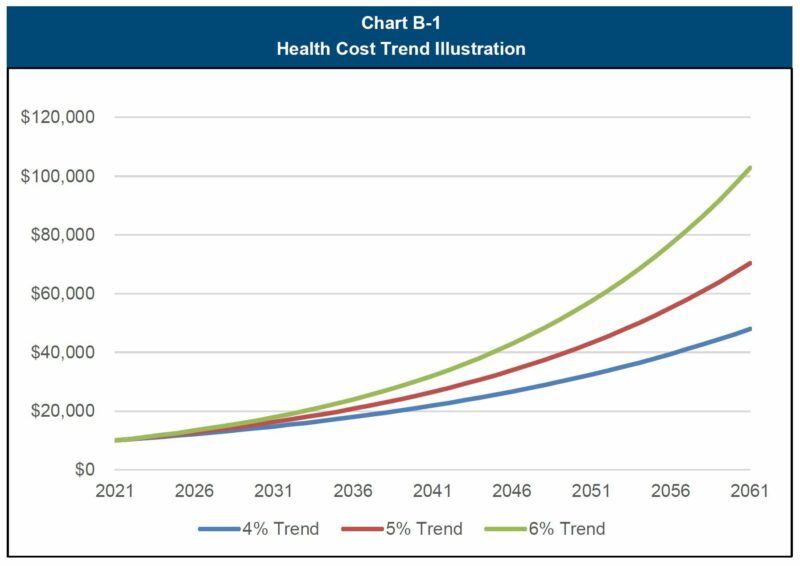

According to Milliman, one of the world's largest independent actuarial and consulting firms, small changes of even one to two percent per year in health care cost trend can result in very large differences in healthcare costs, as shown in the chart below.3

This chart shows three scenarios of growth in health spending over a 40-year period, from a 2021 base of $10,000 per year. Over a 40-year period, the same costs would grow nearly 500% at a 4% annual trend. However, those costs would grow over 1000% at a 6% annual trend; the 2 point increase in trend more than doubles the eventual costs.

You'll find it much more useful to think about healthcare spending as an annual part of your budget, as opposed to a huge lifetime lump sum. But failing to account for healthcare inflation could lead to unwelcome surprises down the road that can derail your retirement planning.

Understanding Medicare

Below is a brief summary of Medicare and its costs. For a more detailed review, read Washington Trust Wealth Management’s ”The ABCs of Medicare: When You’re Sixty-Four.”

Medicare is a federal program that provides healthcare coverage to Americans 65 and over (as well as qualifying individuals with a disability, end-stage kidney failure, or Lou Gehrig’s Disease). Unlike Medicaid, which is for low-income individuals, Medicare is for all qualified Americans, including the wealthy.

Medicare has four parts:

- Part A (inpatient hospital insurance)

- Part B (doctor visits and other outpatient services)

- Part C (Medicare Advantage plans)

- Part D (prescription drug coverage)

You have the option to choose Original Medicare or Medicare Advantage, with the primary differences outlined below.4

Original Medicare | Medicare Advantage (Also known as Part C) | |

|---|---|---|

| Provider/ Administrator |

|

|

| Coverage |

|

|

| Incremental Costs and Limits |

|

|

| Supplemental Coverage |

|

|

Medicare Costs

If you or your spouse have paid FICA (Federal Insurance Contributions Act) during your working years (typically ten years or more), you are entitled to receive Part A premium-free.

For Medicare Parts B and D, you will need to pay premiums. The Social Security Administration determines your Medicare Parts B and D premiums based on your modified adjusted gross income (MAGI), using your income tax return from two years prior. The higher your income, the higher your premiums. High earners may be charged an Income Related Monthly Adjustment (IRMAA), or incremental premiums, which are deducted from your Social Security benefits.

Costs are a major concern when it comes to choosing your health insurance. Part B covers 80% of non-hospital costs, which leaves 20% out of pocket. Any many products and services that become more necessary as we age – glasses, hearing aids, certain medications – generally are not covered by Part A or Part B. Many retirees choose alternative or supplemental plans to help offset those out-of-pocket costs.

Supplemental Insurance - Medigap

Medigap is a supplemental insurance policy sold by private companies that can be used along with Medicare Parts A and B to fill the gaps in their coverage. It can help you cover costs related to deductibles, copayments, coinsurance, and more. A Medigap policy is different from a Medicare Advantage Plan, and policies don’t cover prescription drugs.

There are 10 standardized Medigap plans, named by letters (A-J). Not all plans are offered in every state. Be aware that after your Medigap Open Enrollment Period ends, you may not be able to buy a policy or it may cost more.

Alternative to A and B – Medicare Advantage (Part C)

A Medicare Advantage Plan provides all of your Part A and Part B coverage, plus additional coverage not covered by Original Medicare. The extra coverage varies plan-to-plan, but most of them include Medicare prescription drug coverage (Part D), and many also include include vision, hearing, dental, and/or wellness programs. Medicare Advantage companies must follow federal rules.5

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. In 2022, nearly 7 in 10 beneficiaries (69%) were in zero-premium Medicare Advantage plans, paying nothing beyond the Part B premium, and 87% of Medicare Advantage enrollees were in plans that offered prescription drug coverage.6

Choosing the Right Plan – at the Right Time – Is Critical

It is important to choose the right Medicare plan. Whether to select Medigap vs Medicare Advantage is a common dilemma. Medicare Advantage often is cheaper (and popular for that reason), but the plans often are more restrictive than Medigap plans with regard to coverage and networks and in some states, once choose Part C, you cannot move to Medigap.

It is also very important to make your choice at the right time. Not registering at the right time is one of the biggest mistakes people make when it comes to signing up for Medicare. If you do not have qualified alternative healthcare coverage when you’re turning 65, you need to sign up for Medicare Part B within your seven-month Initial Enrollment Period to avoid a penalty. Once enrolled, annual open enrollment to change your Medicare plan generally is in November.

Luckily, you do not have to make this choice alone. Two federal websites – Medicare.gov or the Social Security Administration site at ssa.gov – can walk you through the Medicare signup process, including costs, options, and deadlines. In addition, Washington Trust Wealth Management works with experts to assist you with making this very important decision, and is happy to make referrals.

Long-Term Care

You might not need long-term care, but if you do, it can be expensive. Expenses related to long-term care have steadily climbed as millions of Americans are living longer and requiring more medical services as they age. Many retirees are under the misconception that Medicare or Medicaid covers long-term care in a nursing home or skilled nursing facility, but they don’t, except under rare special circumstances.

For most people, for the first 20 days, Medicare will pay for 100% of the cost of a nursing home or long-term care facility. For the next 80 days, Medicare pays 80% of the cost.7 Beyond that, long-term care is an out-of-pocket medical expense for most individuals – and one that can wipe out your retirement savings if you are not financially prepared.

The cost of long-term care varies based on care setting, geographic location of care and level of care required, among other things. Understanding the potential costs is a first step to helping you plan for it. Genworth, an insurance holding company, provides a tool to estimate future long-term care costs. For example, they estimate that in 2031 a semi-private room in a nursing home in Rhode Island will cost $12,672 per month or $152,064 annually. In 2041 those estimated costs rise to $17,030 monthly or $204,361 annually.8

Your plan for healthcare costs should separately address the potential for long-term care costs, including in-home nursing, assisted living, or nursing home care. Private long-term care insurance can help ensure you can afford adequate long-term care and end-of-life medical services without depleting your legacy assets, but it can be expensive. Weighing the cost of insurance against the cost of care is a decision that should be made as part of your overall wealth plan.

HSAs Can Help

A health savings account (HSA) – essentially a personal savings account with substantial tax advantages that can be used only for medical expenses – can help offset healthcare costs in the retirement years. HSAs are sometimes called “triple advantaged” because they offer pre-tax contributions (using payroll deduction), tax-deferred growth, and tax-free distributions for qualified medical expenses after age 65. And unlike a Flexible Spending Account (FSA), it’s not a “use it or lose it”; unspent funds can be rolled over for future years.

To be eligible for an HSA, you must be enrolled in a high-deductible health plan (HDHP), which doesn’t work for everyone. In addition, while you can use HSA funds to pay for Medicare premiums, you cannot continue to contribute to an HSA once you enroll in (vs. become eligible for) Medicare. And since Medicare coverage is retroactive for the six months preceding Medicare enrollment, anyone who decided to delay enrollment in Medicare past 65 may need to cease contributions to an HSA earlier.

Your Healthcare Wishes

Does your family know and understand your wishes for your future healthcare, and have you documented those wishes? A basic component of estate and emergency planning involves powers of attorney, which allow someone else to act as your representative for special matters.

Health care powers of attorney (sometimes called a health care proxy, depending on your state) permit an agent to make health care decisions if you are unable. The American Bar Association provides a Toolkit for Healthcare Advance Planning to walk you through the process.

Washington Trust Can Help

Your Washington Trust Wealth Advisor helps you plan ahead for your healthcare expenses to give you the peace of mind that you are prepared and protecting your assets.

When we prepare a financial plan, healthcare cost is an important component. We take you step by step through the process, using interactive planning software to model and explore different scenarios that address inflation, Medicare costs, out-of-pocket costs, and long-term care planning. For example, from our tax planning software, we can model the impact of MAGI changes on IRMAA to help you optimize your Medicare costs and benefits.

Our Wealth Advisors expand beyond the numbers, working with you to bring your family or caregivers into the conversation, to make sure you are all on the same page and have the same expectations. Working together, we will develop a personalized plan to help ensure that you –and your assets – are protected and taken care of during your retirement years.

Healthcare in Retirement: A Glossary

HSA. A Health Savings Account (HAS) is a type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses.

IRMAA. Income Related Monthly Adjustment Amount (IRMAA) is an adjustment to Medicare premiums based on your income. It is often mistaken as an adjustment to the Social Security benefit because it is paid from your Social Security benefit. IRMAA is based on your Modified Adjusted Gross Income (MAGI), which is the sum of your adjusted gross income (AGI), plus tax-exempt interest income.

Medicare Components. The components of Medicare include:

- Part A - Hospital insurance, which covers inpatient care in a hospital or skilled nursing facility, and hospice care.

- Part B - Medical insurance, covers medically necessary doctor’s services, outpatient care home health services, including durable medical equipment, mental health services, and some preventative services.

- Part C - Medicare Advantage, covers all of Medicare Part A and Part B benefits, and potentially other services, such as vision, hearing, and dental services. Most plans also include Medicare Part D.

- Part D - Prescription drug coverage.

Medicare Advantage. Medicare Advantage is a bundled alternative to Original Medicare that includes the coverage of Medicare Part A and Part B, usually Part D (prescription drugs), and often extra benefits such as some dental and vision coverage. Medicare Advantage is sold by private insurance companies that have contracted with the federal government to offer plans.

Medigap. Medigap is a supplemental insurance policy sold by private companies that can be used along with Medicare Parts A and B to fill the gaps in their coverage. It can help cover costs related to deductibles, copayments, coinsurance, and more. A Medigap policy is different from a Medicare Advantage Plan, and policies don’t cover prescription drugs. Medigap only works with Original Medicare. You can’t get a Medigap policy if you have a Medicare Advantage Plan, unless you switch back to Original Medicare.

Original Medicare. Original Medicare benefits include two parts, Part A and Part B, that provide your hospital and medical insurance. If you have a qualifying work history, your Part A benefits are premium-free.

1 HVSFinancial.com, 2022

2 ebri.com 2022

3 Milliman: Health Care Costs in Retirement – 2021 Update

4 Medicare & You 2023: The official U.S. government Medicare handbook

5 What is Medicare Part C? | HHS.gov

6 Medicare Advantage in 2022: Premiums, Out-of-Pocket Limits, Cost Sharing, Supplemental Benefits, Prior Authorization, and Star Ratings | KFF

7 Medicare & You 2023: The official U.S. government Medicare handbook

8 https://www.genworth.com/aging-and-you/finances/cost-of-care.html

Connect with a wealth advisor

No matter where you are in life, we can help. Get started with one of our experts today. Contact us at 800-582-1076 or submit an online form.

This document is intended as a broad overview of some of the services provided to certain types of Washington Trust Wealth Management clients. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. Please consult with a financial counselor, an attorney or tax professional regarding your specific financial, legal or tax situation. No recommendation or advice is being given in this presentation as to whether any investment or fund is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were, or will be, profitable.

Any views or opinions expressed are those of Washington Trust Wealth Management and are subject to change based on product changes, market, and other conditions. All information is current as of the date of this material and is subject to change without notice. This document, and the information contained herein, is not, and does not constitute, a public or retail offer to buy, sell, or hold a security or a public or retail solicitation of an offer to buy, sell, or hold, any fund, units or shares of any fund, security or other instrument, or to participate in any investment strategy, or an offer to render any wealth management services. Past Performance is No Guarantee of Future Results.

It is important to remember that investing entails risk. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions. Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. The value of a portfolio will fluctuate based on market conditions and the value of the underlying securities. Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment loss. Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolio.