You Inherited an IRA. Now What?

February 12, 2025

By Donald Previe, CFP®

Officer and Associate Financial Planner

Washington Trust Wealth Management

The SECURE Act of 2019 changed the rules for inherited IRAs (Individual Retirement Accounts), requiring most non-spouse beneficiaries to withdraw the full balance within 10 years of the original account holder’s death. If you inherit a Roth IRA, withdrawals are tax-free, as long as the original holder held the account for more than five years. However, withdrawals from Traditional IRAs are taxed. Stretching those withdrawals over 10 years, instead of in one large sum, may minimize your tax liability and increase wealth.

Step 1: Call Your Financial Planner

Your first call when inheriting an IRA should be to your financial planner or wealth advisor, who can:

- Map out future income to identify opportunities for tax and income planning.

- Help create a dynamic plan that optimizes taxable distributions each year.

- Identify strategies to utilize the funds once they are withdrawn, that support your financial goals.

Step 2: Does the 10-Year Rule Apply?

There are several exceptions to the 10-year rule, allowing certain beneficiaries to stretch distributions over their lifetime, including surviving spouses (who can roll over to their own IRA), minor children (until they reach adulthood), and disabled or chronically ill individuals.[i]Learn more here.

Step 3: Know Your RMDs

Before developing a withdrawal strategy, you need to know what, if any, required minimum distributions (RMDs) you are subject to. Beneficiaries who inherited an IRA after 2020, may not have taken an RMD yet, but that is changing in 2025. Learn about RMD requirements here or speak to your wealth advisor.

Step 4: Strategies for Withdrawals

Waiting to withdraw large balances in year 10 may fail to utilize lower tax brackets within the 10-year period, leading to more of the money being withdrawn at the highest possible tax bracket. These strategies can help avoid that.

Withdrawal strategies

- Take equal annual withdrawals. Divide the IRA balance by 10 and withdraw that amount each year. This helps maintain a steady tax impact and prevents a large tax hit in year 10.

- Withdraw more in low-income years. If you anticipate fluctuating income in the coming years—such as an upcoming retirement—take larger withdrawals in lower-income years to minimize tax impact.

- Delay withdrawals until later in the 10-year period. You could let the IRA grow tax-deferred and take larger distributions in later years, as long as it won’t push you into a higher tax bracket when withdrawals are forced.

Note: You are not locked into a single strategy for 10 years. With proper planning, new tax efficiencies can be found each year, creating opportunities to shift to a new strategy.

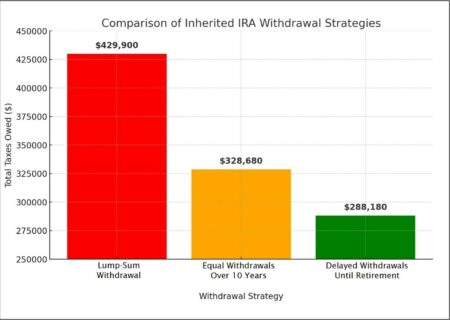

Case Study: Comparing Tax Impacts

Let’s say you:

- Live in Rhode Island (with a top state tax rate of 5.99%)

- Have a current taxable income of $350,000 (current federal tax bracket: 32%)

- Are retiring in three years (with income drop and lower tax bracket of 22% - 24%)

- Inherit a $1,000,000 Traditional IRA

Scenario Analysis: Withdrawal Strategies

1. Immediate Lump-Sum Withdrawal (Least tax-efficient))

- Withdrawing $1,000,000 this year adds to your $350,000 salary, making your total taxable income $1.35M.

- This pushes you into the highest 37% federal tax bracket.

- Federal Taxes on IRA: ~$370,000

- RI State Taxes on IRA (5.99%): ~$59,900

- Total Taxes Owed: $429,900

✅ Highest tax liability

2. Equal Withdrawals Over 10 Years (Simplest Approach)

- Withdraw $100,000 per year for 10 years.

- First 3 years (before retirement, income $350K)

- Federal tax rate: 32%

- State tax rate: 5.99%

- Taxes per year: ~$37,990

- After retirement (income $100K or less)

- Federal tax rate: 22%-24%

- State tax rate: ~4.75%

- Taxes per year: ~$26,750

- Total Taxes Owed (10 years): $328,680

✅ Saves ~$101,220 versus lump sum.

3. Delay Withdrawals Until Retirement, Then Take Equal Withdrawals (Most Tax-Efficient)

- Skip withdrawals for 3 years while earning $350K.

- Withdraw $142,857 per year for the remaining 7 years.

- Federal Tax Bracket (After Retirement): ~24%

- State Tax Rate (Lower Bracket): ~4.75%

- Total Taxes Owed: $288,180

✅ Saves ~$141,720 versus lump sum and ~$40,500 versus equal withdrawals.

Case Study Recommendation

✅ Wait until retirement (three years), then withdraw ~$142,857 per year for seven years.

✅ This saves about $141,720 compared to taking a lump sum now and keeps more inheritance for future growth and retirement planning.

Washington Trust Wealth Management is Here to Help

The qualified and experienced Certified Financial Planners (CFP®) and wealth managers at Washington Trust will help guide you in developing short- and long-term strategies to minimize tax liability with an inherited IRA. Your wealth manager can also work with you to calculate and maximize potential investment growth, regardless of which withdrawal strategy you choose.

Connect with a wealth advisor

No matter where you are in life, we can help. Get started with one of our experts today. Contact us at 800-582-1076 or submit an online form.

This document is intended as a broad overview of some of the services provided to certain types of Washington Trust Wealth Management clients. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting, actuarial or tax advice. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. Please consult with a financial counselor, an attorney or tax professional regarding your specific financial, legal or tax situation. No recommendation or advice is being given in this presentation as to whether any investment or fund is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were, or will be, profitable.

Any views or opinions expressed are those of Washington Trust Wealth Management and are subject to change based on product changes, market, and other conditions. All information is current as of the date of this material and is subject to change without notice. This document, and the information contained herein, is not, and does not constitute, a public or retail offer to buy, sell, or hold a security or a public or retail solicitation of an offer to buy, sell, or hold, any fund, units or shares of any fund, security or other instrument, or to participate in any investment strategy, or an offer to render any wealth management services. Past Performance is No Guarantee of Future Results.

It is important to remember that investing entails risk. Stock markets and investments in individual stocks are volatile and can decline significantly in response to issuer, market, economic, political, regulatory, geopolitical, and other conditions. Investments in foreign markets through issuers or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. Emerging markets can have less market structure, depth, and regulatory oversight and greater political, social, and economic instability than developed markets. Fixed Income investments, including floating rate bonds, involve risks such as interest rate risk, credit risk and market risk, including the possible loss of principal. Interest rate risk is the risk that interest rates will rise, causing bond prices to fall. The value of a portfolio will fluctuate based on market conditions and the value of the underlying securities. Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment loss. Investors should contact a tax advisor regarding the suitability of tax-exempt investments in their portfolio.